Bringing a car into Portugal isn’t as simple as just parking it in your driveway—it comes with its fair share of bureaucracy. Taxes, paperwork, and regulations can make the process feel overwhelming, but we’re here to break it down for you.

In this guide, we’ll walk you through the key taxes you’ll encounter, including Imposto sobre Veículos (ISV), Value Added Tax (VAT), Documento Único de Circulação (DUC), and road tax. We’ll also explain the **two main ways to import your vehicle—tax-free or with taxes—**and what factors influence those costs, such as car size, emissions, and fuel type.

Let’s dive in and make your car import as smooth as possible!

Let’s Break Down the Tax Stuff

Imposto sobre Veículos (ISV)

ISV (Imposto sobre Veículos) is the main tax you’ll face when registering a vehicle in Portugal. The amount you’ll pay depends on several factors, including engine size, fuel type, and CO₂ emissions. Generally, larger vehicles and diesel cars tend to get hit with a higher ISV bill.

Can you avoid ISV?

If you’re moving to Portugal permanently, you may be able to import your car tax-free, meaning you won’t have to pay ISV—provided you meet the right conditions.

How ISV is Calculated

Figuring out ISV is a bit like solving a complex equation—it takes into account:

✔ CO₂ emissions

✔ Engine size

✔ Car age

If you’re considering importing your car to Portugal, understanding this formula is crucial for budgeting properly. We’re here to help you navigate the numbers and make sure you know exactly what to expect!

Value Added Tax (VAT)

If you’re importing a car from outside the EU, Value Added Tax (VAT) also comes into play. However, if you’re relocating to Portugal, your car may qualify for a VAT exemption, saving you a significant amount.

When Does VAT Apply?

✔ Importing from an EU country? No VAT on the purchase—one less thing to worry about.

✔ Importing from outside the EU? VAT must be paid, and it’s calculated based on the car’s current market value in Portugal.

If you’re planning your budget for an import, keeping VAT in mind is essential—it can make a big difference in your total costs!

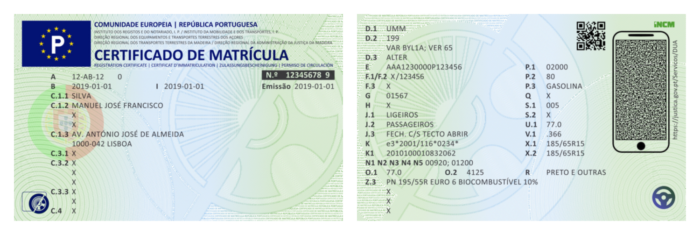

Documento Único de Automóvel (DUA)

Meet the DUA (Documento Único Automóvel)—your car’s official registration document in Portugal. Think of it as your vehicle’s passport, proving it meets all legal, safety, and environmental requirements. Without it, your car isn’t road-legal.

What You Need to Know About the DUA

The DUA is essential for proving your car is properly registered.

You’ll receive a DUA certificate if your car undergoes significant modifications or ownership changes.

Road Tax (Imposto Único de Circulação – IUC)

The final tax to consider is road tax, known in Portugal as IUC (Imposto Único de Circulação). This annual fee applies to all registered vehicles and is determined by factors such as engine size, fuel type, and CO₂ emissions. In general, larger and higher-emission vehicles face higher IUC costs.

Understanding IUC

IUC functions as a recurring tax that keeps your vehicle legally on Portuguese roads. Knowing how it is calculated will help you plan for ongoing costs and avoid unexpected expenses.

One key point to note is that cars first registered before July 2007 fall under the lower IUC regime, meaning they pay significantly less in road tax compared to newer vehicles. This can make importing an older car cost-effective.

Importing with Taxes

Deciding how to bring your car into Portugal is like choosing between two roads – the tax route or the tax-free option. Each has its own rules, costs, and benefits, and the right choice depends on your situation and eligibility.

Importing with Taxes: When It Makes Sense

For those not eligible for a tax-free import, the standard process involves paying ISV (vehicle tax) and, in some cases, VAT. However, in certain situations, importing with taxes can actually be the cheaper option—for example, if your vehicle’s tax burden is low due to its small engine size, low emissions, or classification as a commercial vehicle.

Tax-Packed Arrival

Choosing to import with taxes means navigating a process where you’ll need to account for Imposto sobre Veículos (ISV), Value Added Tax (VAT), and various other associated fees. While this option is available to everyone, the total cost varies significantly depending on several key factors.

What Influences the Tax Burden?

The amount you’ll pay depends on:

✔ Engine size – Larger engines typically face higher ISV charges.

✔ Fuel type – Diesel vehicles often come with additional costs.

✔ CO₂ emissions – Higher emissions mean a higher tax bracket.

✔ Vehicle age – Older EU vehicles benefit from tax reductions, while non-EU imports face full charges.

Car Size and ISV

When it comes to ISV, your car’s size matters. It’s not just about the make and model—it’s about how engine capacity and emissions factor into the tax calculation. Understanding these details is essential for accurate budgeting when importing a vehicle into Portugal.

Larger Vehicles, Higher ISV

Bigger vehicles, such as SUVs and luxury models, typically face higher ISV charges. This is because they generally:

✔ Consume more fuel

✔ Produce higher CO₂ emissions

✔ Have a greater impact on infrastructure

Fuel Type and ISV

The type of fuel your car runs on plays a significant role in determining ISV costs. Whether it’s diesel, gasoline, hybrid, plug-in hybrid, or fully electric, each option comes with its own tax implications, influencing the total cost of your import.

Diesel vs. Gasoline: The Traditional Dilemma

✔ Diesel vehicles are generally more fuel-efficient, but they often face higher ISV charges.

✔ Gasoline cars typically have lower ISV costs, especially if they have small engines and low CO₂ emissions.

Electric Vehicles: The ISV-Free Advantage

✔ Fully electric vehicles (EVs) are completely exempt from ISV, making them one of the most cost-effective options for import.

✔ No CO₂ emissions means no environmental tax component, resulting in significant savings compared to traditional fuel-powered cars.

Hybrid & Plug-In Hybrid Vehicles: A Middle Ground

✔ Standard hybrid vehicles (non-plug-in) still generate some CO₂ emissions, so they are subject to ISV, but often at a lower rate than diesel or gasoline cars.

✔ Plug-in hybrids (PHEVs) can qualify for a reduced ISV.

Hybrids receive a tax-discount when they meet two key criteria:

- CO₂ emissions under 50 g/km

- Minimum electric range of 50 km (or 25 km for certain models registered before 2020)

Choosing the Right Fuel Type for Import

ISV Exemption

For those relocating to Portugal, there is the possibility of an ISV exemption, allowing you to import your car tax-free. However, gaining access to this tax-free benefit comes with strict eligibility requirements that must be met.

Ownership Duration

To qualify for tax-free import and embrace the ISV exemption, you must have owned your vehicle for at least six months before your move to Portugal. This ownership period is a crucial criterion for determining eligibility, and maintaining thorough records during this time is essential.

By keeping detailed proof of ownership, such as registration documents and a purchase invoice, you’ll ensure a smooth transition into the world of tax exemption, avoiding unnecessary hurdles along the way.

Proof of Previous Residence

A crucial requirement for tax-free import is proving that you lived in your previous country for at least 6 consecutive months before moving to Portugal. This solid residency history is essential to qualify for the ISV exemption.

To build a strong case, you’ll need to provide a comprehensive set of documents, such as:

✔ Utility bills (electricity, water, gas)

✔ Rental agreements or mortgage statements

✔ Employment or tax records

✔ Official government documents confirming residence

Importers should be well-prepared to demonstrate a genuine and continuous connection to their former country. A well-documented residency history ensures a smooth and successful tax-free import process.

Timing Matters: Initiating the Tax-Free Import on Time

To qualify for ISV exemption, the import process must begin within 12 months of officially establishing residency in Portugal. Strict adherence to this timeline is crucial, as missing this deadline can result in losing eligibility for tax-free import.

Delays in initiating the procedure may mean paying full import taxes, so careful planning and prompt action are essential to securing this valuable tax-saving opportunity. Understanding the importance of timing ensures a smooth and cost-effective transition for your vehicle into Portugal.

These so-called ‘proof of living’ documents must match the date of your deregistration document.

Conclusion

Importing a car to Portugal is a multifaceted process that requires careful planning, a solid understanding of tax regulations, and strict adherence to timelines. Whether you choose the tax-inclusive route or qualify for the tax-free ISV exemption, thorough preparation is key to ensuring a smooth and cost-effective importation experience.

By understanding the intricacies of ISV, VAT, DUC, and road tax, you can confidently approach the process, making informed decisions that align with both your preferences and budget. Factors such as vehicle size, fuel type, ownership duration, proof of previous residence, and relocation evidence all play a critical role in determining eligibility and overall costs.

For those embarking on this journey, knowledge and strategic planning are essential. By staying informed and taking the right steps at the right time, you can successfully navigate Portugal’s tax landscape and enjoy the freedom of driving on Portuguese roads with peace of mind.

Need Assistance?

Navigating the complexities of importing your car to Portugal may seem overwhelming, but don’t worry—we’re here to make the process smooth and hassle-free. Whether you prefer a hands-off approach or want to be actively involved with our guidance, our tailored services adapt to your needs.

Choose the Right Package for You

Basic Package – A cost-effective option for those on a budget who still want professional guidance. This package includes:

- Full importation of your vehicle

- Relevant links and essential documents to help streamline the process

- Step-by-step support to ensure everything runs smoothly

Deluxe Package – A customizable, all-inclusive service for those who need extra assistance at every step.

Why Work With Us?

Our dedicated team ensures that you don’t have to deal with complicated procedures alone. We handle the details so that you can focus on the excitement of having your vehicle join you on Portugal’s scenic roads. With our expertise, you can confidently navigate the process, knowing you have a trusted partner guiding you every step of the way.

![Bringing a car into Portugal isn’t as simple as just parking it in your driveway—it comes with its fair share of bureaucracy. Taxes, paperwork, and regulations can make the process feel overwhelming, but we’re here to break it down for you. In this guide, we’ll walk you through the key taxes you’ll encounter, including Imposto […]](https://carimportportugal.com/wp-content/uploads/sites/100/zlal2ukpn4k-1.jpg)