Embarking on the journey of importing a vehicle to Portugal unveils a maze of acronyms, and one that takes center stage is ISV – Imposto sobre Veículos. In this guide, we’ll demystify ISV, breaking down what it is, how it’s calculated, and its pivotal role in the taxation landscape.

Unpacking ISV

Imposto sobre Veículos (ISV): ISV is the tax levied on registering vehicles in Portugal. ISV plays a crucial role in the financial equation of car ownership.

ISV Calculation – The Formula

Calculating ISV is done by the following formula:

Categories taken into account

- Engine Size: The power under the hood matters. Larger engines may incur higher ISV charges.

- CO2 Emissions: The environmental impact of your vehicle is a significant factor. The higher the CO2 emissions, the greater the tax burden.

- Car Age: Aging like fine wine – vehicles get a deduction for each passing year. However, the specific deductions vary based on fuel type and emissions.

- Type of Vehicle: The type of vehicle makes a major impact on the ISV amount. Heavy commercial vehicles do not pay ISV.

- The Tax-Free Option – ISV Exemption

For those making Portugal their new home, there is ISV exemption.

1. Engine Size

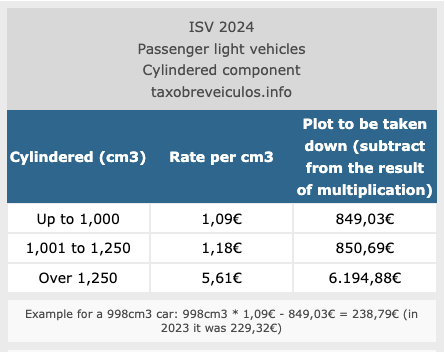

The first component of the ISV calculation is the engine size. The following table shows how this component is calculated:

2. CO2 emissions

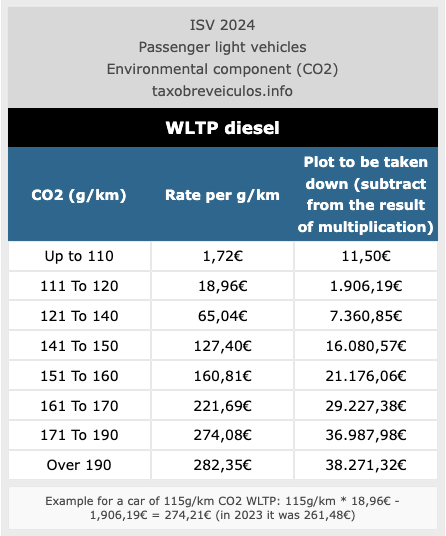

A car’s CO2 emissions are measured by NEDC or WLTP standards. You can find this information on your car’s COC document, or by looking up the specifications of your exact model online. Here is an example for a WLTP diesel vehicle:

Good to know: there is an additional increase of 500 euros for diesel vehicles that emit more than 0.001g/km or more of particulate matter. Usually when a vehicle has a particulate filter, you won’t have to deal with this fee.

3. Car Age

The age of your vehicle is another deciding factor in calculating the ISV. It will give you a reduction on the engine size component as well as on the CO2 component. Here is an example:

Have a look at the official website if you want to see the other tables.

4. Type of vehicle

The type of vehicle is crucial when it comes to calculating ISV.

Hybrids, natural gas vehicles and electric vehicles are cheaper.

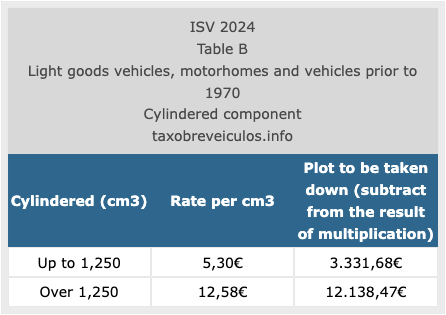

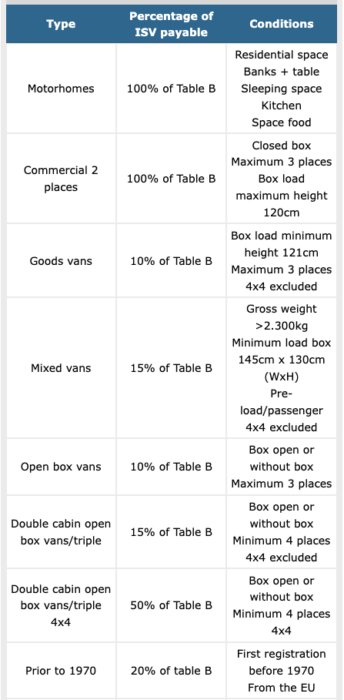

Other kinds of vehicles, such as commercial vehicles may also be cheaper. They are calculated without the CO2 component as is shown in this table:

The ISV amount is shown as a percentage. So when importing a ‘goods van’ you only pay 10% ISV, as calculated by via the above table. Diesel vehicles cost an additional 250 euros if they do not have a particle filter.

*ISV on motorhomes is gradually rising to 100%. It used to be ISV-free and at the moment of this writing, it’s sitting at 40%

What’s next?

To find more information for your car, you can have a look at the at the official website if you want to see the other tables. You may also calculate the ISV for regular cars, for motorhomes, and for commercial vehicles.

Hopefully this will give you some insight on what type of vehicle to import. If you are moving to Portugal, you may be able to import tax-free.

If you would like help with your import, we are here to help you. Please contact us.